🎉 Big news: Velos was awarded best pitch at the Cyber NetDiligence Power Pitch Competition

🎉 Velos won best pitch at the Cyber NetDiligence Power Pitch Competition

🎉 Big news: Velos was awarded best pitch at the Cyber NetDiligence Power Pitch Competition

Backed by YCombinator

Never

Never

|

|

We help carriers and MGAs keep more premium by cutting the cost it takes to handle recurring manual tasks and reducing expensive errors in those processes.

We help carriers and MGAs keep more premium by cutting the cost it takes to handle recurring manual tasks and reducing expensive errors in those processes.

We help carriers and MGAs keep more premium by cutting the cost it takes to handle recurring manual tasks and reducing expensive errors in those processes.

Trusted by insurance and finance teams

Trusted by insurance and finance teams

Who we serve

We work with carriers, MGAs, and TPAs across all major commercial lines—specializing where complexity breaks traditional automation.

Problem

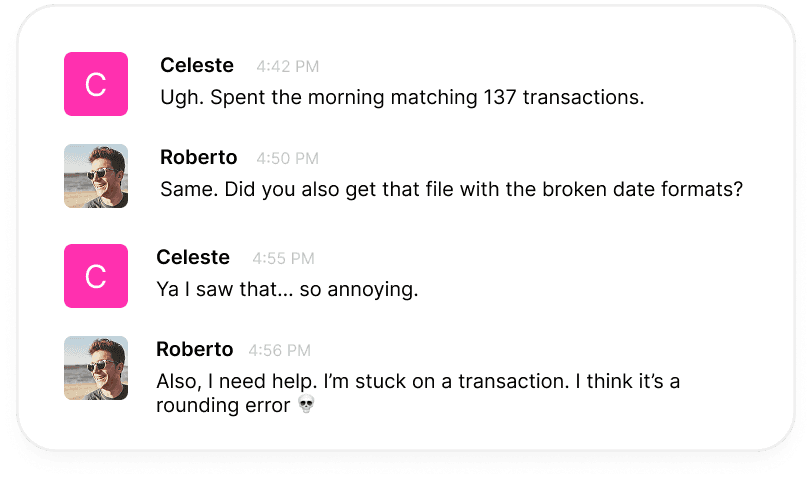

Manual insurance operations don’t scale.

Manual insurance operations don’t scale.

Carriers and MGAs are asked to handle more submissions, more capacity partners, more reporting, and more audits but the work still lives in emails, PDFs, spreadsheets, and one-off processes.

At scale, those cracks turn into real costs. Missed revenue, strained carrier relationships, and compliance risk.

Carriers and MGAs are asked to handle more submissions, more capacity partners, more reporting, and more audits but the work still lives in emails, PDFs, spreadsheets, and one-off processes.

At scale, those cracks turn into real costs. Missed revenue, strained carrier relationships, and compliance risk.

Carriers and MGAs are asked to handle more submissions, more capacity partners, more reporting, and more audits but the work still lives in emails, PDFs, spreadsheets, and one-off processes.

At scale, those cracks turn into real costs. Missed revenue, strained carrier relationships, and compliance risk.

Existing solutions

Most offshore teams underdeliver.

Most tools take too long to get right.

Most offshore teams underdeliver.

Most tools take too long to get right.

Most tools take too long to get right.

Most offshore teams underdeliver.

Tools like UiPath require too much tinkering & testing to get right.

Tools like UiPath require too much tinkering & testing to get right.

Offshore teams introduce human error, have high oversight costs and are slow to ramp.

Offshore teams or BPOs introduce human error and high oversight costs. As your business grows, so does the offshore team

And your people hate doing this work since it's highly repetitive, tedious, and manual.

And your people hate doing this work since it's highly repetitive, tedious, and manual.

Our Platform

One platform to automate all your insurance processes

One platform to automate all your insurance processes

Not another underwriting workbench or AI chatbot. Automate manual data processes without the cost, risk, or disruption of replacing your policy or underwriting systems.

Not another underwriting workbench or AI chatbot. Automate manual data processes without the cost, risk, or disruption of replacing your policy or underwriting systems.

Submission intake & triage

Submission intake & triage

Problem: Underwriting teams struggle with an overwhelming number of submissions, filled with unstructured data trapped in loss runs and other complex documents.

Outcome: Automatically extract, enrich, and check information against underwriting guidelines and third-party sources. Flag missing or inconsistent details before it gets to an underwriter

Problem: Underwriting teams struggle with an overwhelming number of submissions, filled with unstructured data trapped in loss runs and other complex documents.

Outcome: Automatically extract, enrich, and check information against underwriting guidelines and third-party sources. Flag missing or inconsistent details before it gets to an underwriter

3× increase in UW capacity

Faster broker turnaround

FNOL Processing

FNOL Processing

Problem: FNOL intake is fragmented and manual, arriving through multiple channels. Claims teams spend hours rekeying data, increasing the risk of missed or delayed claims.

Outcome: Automate FNOL intake across any channel, shrinking claim setup from hours to minutes. Capture every FNOL to prevent missed claims while enabling faster triage and timely declinations.

Problem: FNOL intake is fragmented and manual, arriving through multiple channels. Claims teams spend hours rekeying data, increasing the risk of missed or delayed claims.

Outcome: Automate FNOL intake across any channel, shrinking claim setup from hours to minutes. Capture every FNOL to prevent missed claims while enabling faster triage and timely declinations.

Zero FNOL leakage

90% reduction in manual intervention

Bordereaux Processing

Bordereaux Processing

Problem: MGAs spend hours reworking spreadsheets to meet different carrier requirements, forcing headcount growth as volume increases.

Outcome: Standardizes bdx reporting across carriers and lines of business, cutting manual effort by 70%+. Enables MGAs to scale premium without scaling headcount.

Problem: MGAs spend hours reworking spreadsheets to meet different carrier requirements, forcing headcount growth as volume increases.

Outcome: Standardizes bdx reporting across carriers and lines of business, cutting manual effort by 70%+. Enables MGAs to scale premium without scaling headcount.

From days to hours

Never miss off-binder risks

Our Process

We implement it for you

We implement it for you

We design, develop, and implement automations that help you work smarter, not harder

Step 1

Onboarding & Strategy

We gather insights about your processes, edge cases, and goals.

Step 2

Automation Build Out

We build out your first workflow based on an SOP that we create together.

Step 3

QA & Launch

We have your team rigorously test the automation for any kinks and once it's passed the sniff test, we ship it.

Step 4

Continuous optimization

We refine performance and enhance automation so you don't have to spend time tinkering.

Trusted by insurance professionals to automate complex workflows

Most tools take too long to get right.

Most offshore teams underdeliver.

“Every month, we’re required to report data from over 200 dealerships to our capacity partner. It’s a highly manual, error-prone process. Velos demonstrated a clear ability to automate complex data processes that historically could only be handled by people."

Jeff Martins

CEO of Gable I MGA

“Every month, we’re required to report data from over 200 dealerships to our capacity partner. It’s a highly manual, error-prone process. Velos demonstrated a clear ability to automate complex data processes that historically could only be handled by people."

Jeff Martins

CEO of Gable I MGA

“Every month, we’re required to report data from over 200 dealerships to our capacity partner. It’s a highly manual, error-prone process. Velos demonstrated a clear ability to automate complex data processes that historically could only be handled by people."

Jeff Martins

CEO of Gable I MGA

Differentiation

Why Velos? We're a different kind of automation partner.

Why Velos? We're a different kind of automation partner.

We thrive where complexity is highest and expertise matters most.

We’re far cheaper than hiring, offshoring, or third-party processors because we use software behind the scenes.

We’re far cheaper than hiring a FTE or using an offshore team because we use software behind the scenes.

We go live in under 30 days with no implementation cost.

Fully managed service, built to integrate with any core systems you use.

Why Velos? We are a different kind of automation partner.

We thrive where complexity is highest and expertise matters most.

We’re far cheaper than hiring a FTE or using an offshore team because we use software behind the scenes.

We go live in under 30 days with no implementation cost.

Fully managed service, built to integrate with any core systems you use.

Know that your data, models, and knowledge are secure

Know that your data, models, and knowledge are secure

Enterprise-grade security — SOC 2 Type II certified, AES-256 encryption, GDRP Compliant.

Enterprise-grade security — SOC 2 Type II certified, AES-256 encryption, GDRP Compliant.

Zero training on your data

Your data is never used to train AI — your privacy is protected by comprehensive data agreements.

Data retention policies

Our data processing agreements can be adapted to ensure compliance with your industries specific regulatory standards.

Your automations are yours

Your proprietary data is under your control. Each customer's instance is kept fully isolated.

Zero training on your data

Your data is never used to train AI — your privacy is protected by comprehensive data agreements.

Data retention policies

Our data processing agreements can be adapted to ensure compliance with your industries specific regulatory standards.

Your automations are yours

Your proprietary data is under your control. Each customer's instance is kept fully isolated.

See it work, before you buy.

See it work, before you buy.

See it work, before you buy.

Too many teams commit to annual contracts with vendors and offshore teams who take months to go live.

That's why we offer a risk-free high speed pilot, where we build a real automation with you. If there's value it's a no brainer, and if there's not, no sweat.

Too many teams commit to annual contracts with vendors and offshore teams who take months to go live.

That's why we offer a risk-free high speed pilot, where we build a real automation with you. If there's value it's a no brainer, and if there's not, no sweat.

The automation partner built for the toughest submissions & claims.

Velos is the only automation partner combining an end-to-end platform with managed implementation. Book a demo to see how to outsource your messy processes to AI.

The automation partner built for the toughest submissions & claims.

Velos is the only automation partner combining an end-to-end platform with managed implementation. Book a demo to see how to outsource your messy processes to AI.

The automation partner built for the toughest submissions & claims.

Velos is the only automation partner combining an end-to-end platform with managed implementation. Book a demo to see how to outsource your messy processes to AI.